Infrastructure: 2019 in Review

January 2020

In January 2019, Infrastructure Ideas made 10 predictions for 2019. With the year closed, it’s time to take a look at how things unfolded. And twelve months later, the world looks a lot like we expected it to: of Infrastructure Ideas’ 10 predictions for 2019, 7 hit the mark, one came close, and two were premature. Essentially identical to our track record for the same exercise in 2018. All in all, a continued year of change in the world of infrastructure.

Here were seven predictions on the mark:

1. Wind and solar power keep growing and getting cheaper… and lagging aspirations. The march of “world-record pricing” had slowed in 2018, but picked back up in 2019. In Brazil and Portugal, solar auctions netted new PPA commitments of 1.7 US cents per kilowatt/hour, bringing the threshold for new solar power availability down below two cents for the first time. The “record” price for solar power at the beginning of last decade? 34 cents. By 2019 solar price records have fallen no less than 95%. Sounds like a lot to us. The record price now for wind PPAs? Even lower — 1.1 cents per kilowatt/hour. Solar and wind each will have seen over $1 Trillion in investment over the last decade, clean energy accounted for over 40% of electricity production in both Germany and the US in 2019, while solar and wind accounted for some 50% of all new power investment in the US in 2019. China’s cumulative investment in wind and solar capacity now exceeds 2,000 GW. Yet while cheaper renewables continue to be the “new normal,” the decline in worldwide greenhouse gas emissions also continues to look far off what is needed to slow global warming. So we expect the underlying pressure to “do more” (read, accelerate the retirement of existing fossil-fuel fired electricity plants) to continue to build.

2. New records in energy storage. We said this was the easiest of all 2019 predictions, and so it proved to be. Bid prices for combined solar generation plus four-hour storage in a pair of US states came in below $0.04/KwH, roughly half the record of 3 years ago, and half the cost of greenfield coal power generation. Largest electricity storage projects jumped from 100 MW to 700 MW, with a number of projects around 400 MW. Our September column, Checking in on Energy Storage costs, goes into more detail on the trend.

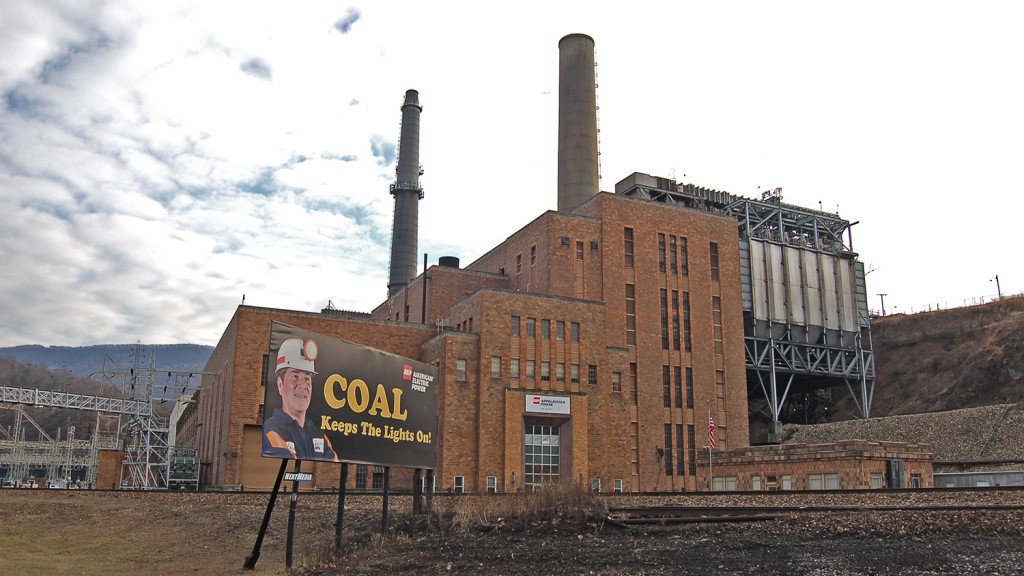

3. Intensified pressure on coal-fired plants. Production of coal in the US in 2019 fell to its lowest level in 40 years. Many of the largest industry players are in bankruptcy. Worldwide the number of completed coal plants has fallen by half since 2015. Coal-fired generation costs are either steady or rising, depending on the market, while prices of alternatives keep tumbling. Political pressure, in spite of the Trump administration, will continue to get worse as concerns over climate grow. See our October series on coal for more on this (What next for coal, The Coming Decommissioning Wave, and Blue Coal ?).

4. Urban infrastructure keeps center stage. 2019 saw continued large investments in new mobility technologies. IPOs by Uber and Lyft held the headlines, while McKinsey noted that micro-mobility investments have exceeded $100 billion in the past two years (see Start Me Up: Where Mobility Investments are Going).

5. Charging infrastructure starts to mature. The global population of battery-powered passenger cars on the roads passed 5 million last year, keeping up with its 50% annual growth rate since 2013. EV support infrastructure has grown alongside: venture investments in EV infrastructure companies totaled $1.7 billion from 2010 through the first half of 2019. ChargePoint today operates the largest network of public chargers, with more than 99,000 units in the fleet. A big turning point in 2019 was, however, in business models for charging infrastructure. Tesla rolled out its “Supercharger network,” essentially marketing EV charging as extensive and simple and so helping to overcome many buyers’ concerns about the hassles of recharging. In November, Ford followed suit and announced it will provide customers with two years of free access to an app called the FordPass Charging Network, which will include expedited use of “more than 12,000 charging stations with more than 35,000 plugs.” Ford is teaming with Electrify America, which has a fast-growing network, and with Greenlots (owned by Shell), which is developing and mapping EV charging stations. Ford is partnering as well with Amazon to offer installation of at-home charging outlets, again seeking to simplify installation of home charging infrastructure. With these moves, we can expect investment in EV charging infrastructure to continue accelerating, as EV ownership reaches critical mass to make these investments pay off.

6. Buses outdraw subways. Subway system projects worldwide continued to struggle. Washington DC’s Silver Line extension is now at least 18 months in arrears. The generally successful Santiago, Chile, subway needs major repairs to stations which were damaged in the 2019 wave of protests. Asia has accounted for 90% of planned subway investments, and trends there are clear. China, where the largest number of new systems has been concentrated in the past two decades, has cut back on new projects. Jakarta was one of the few cities managing to open a new system (three decades in the planning), while Manila’s long-delayed first subway is finally nearing its operational debut. In contrast, investments in new bus lines and systems continues to be strong, whether in BRT (Bus Rapid Transit) or electrification. The world’s largest transport market, China, continues to pour significant funding into buses while it cuts back on new subway projects (see February’s EV Buses column). The continued message for urban transport planning: bus systems are getting cleaner and cheaper, and most importantly are far less prone to the major cost overruns and delays associated with subway construction.

7. A lot of talk will stay talk, not action. We weren’t expecting a US infrastructure plan, infrastructure policy reforms in major emerging markets like Argentina, Indonesia, Nigeria, or South Africa, or a major international accord on climate change regulation. We didn’t get them.

One Infrastructure Ideas prediction was sort of in line, but not entirely on the mark. This was our prediction of 2019 as The year of climate lawsuits. 2019 did indeed see landmark climate-related lawsuits, including the high-profile US Supreme Court decision in December that Exxon did not commit fraud in misleading investors on climate change. PG&E, one of the largest US utilities, was forced into bankruptcy due to attributed responsibility in California’s wildfire epidemic (see our column The PG&E Bankruptcy, from January). Nine US cities and counties have lawsuits in process against fossil fuel companies, and a variety of additional class action and individual lawsuits are percolating. But none of the legal challenges have yet resulted in a “tobacco” style judgment, or crippling liabilities and fines beyond the special case of PG&E. But it feels like attempting to hold back the tide.

Two predictions for 2019 have proven premature.

• Hydropower starts to take on water. Hydropower continues to have significant support from climate change campaigners, as a means of reducing fossil fuel emissions. Large hydropower projects also continue to attract significant criticism on environmental and social grounds. Macedonia, Guatemala, Russia and Laos have all cancelled major planned hydropower projects in the last two years, essentially on E&S grounds. But the coming game-changer for hydropower is neither of these, and instead is technology change – or the lack of it. Large hydropower projects are complex and often problematic, and their costs are increasing or at best steady – while the costs of alternative technologies (natural gas, solar and wind) are falling rapidly. We continue to expect large hydropower projects to begin to be abandoned on economic grounds, though we are not yet seeing it.

• New technology comes to water. The energy and transportation sectors have been heavily disrupted by new technology over the last decade. Change is coming to water: the combination of nanotechnology and drones will make possible a massive improvement in the ability of water utilities to find and fix leaky pipes in their hundreds of miles of underground pipes. The movement was not yet large-scale in 2019, but can be expected to be so before long.

Coming up next: our ten infrastructure predictions for the year ahead in 2020.

Bonsoir Bernie

Very interesting (and well written) as always. I note that when Infrastructure Ideas predictions do not materialize, it merely means they were “premature” !

😊

Looking fwd for next week post – re 2020 predictions. Especially as I have to work on a key note speech I have to deliver at a forthcoming RE conference !…

Warm regards

Bertrand

LikeLike